Description

Efnisyfirlit

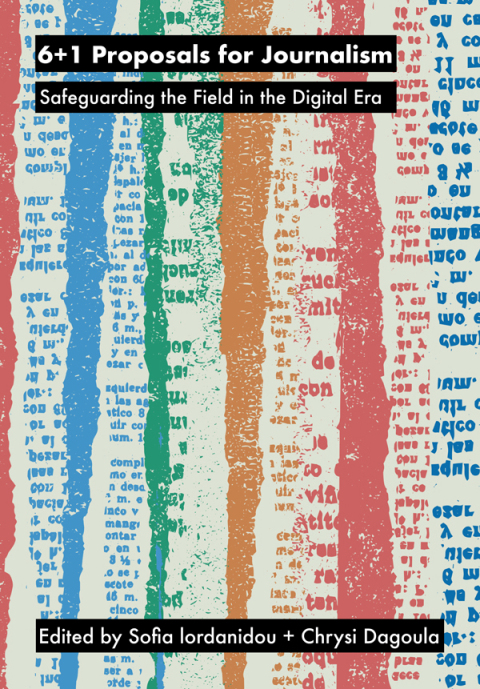

- Cover

- Introduction

- About This Book

- Foolish Assumptions

- Icons Used in This Book

- Where to Go from Here

- Part 1: Getting into the Swing of Things

- Chapter 1: Swing Trading from A to Z

- Understanding What Swing Trading Is (and Isn’t)

- What Swing Trading Is to You: Determining Your Time Commitment

- Sneaking a Peek at the Swing Trader’s Strategic Plan

- Building Your Swing Trading Prowess

- Chapter 2: Understanding the Swing Trader’s Two Main Strategies

- Strategy and Style: The Swing Trader’s Bio

- Wrapping Your Mind around Technical Theory

- Appreciating the Value of the Big Picture: Fundamental Theory

- Chapter 3: Focusing on the Small Stuff: The Administrative Tasks

- Hooking Up with a Broker

- Selecting Service Providers

- Starting a Trading Journal

- Creating a Winning Mindset

- Part 2: Timing Is Everything: Technical Analysis

- Chapter 4: Charting the Market

- Nailing Down the Concepts: The Roles of Price and Volume in Charting

- Having Fun with Pictures: The Four Main Chart Types

- Charts in Action: A Pictorial View of the Security Cycle of Life

- Assessing Trading-Crowd Psychology: Popular Patterns for All Chart Types

- Letting Special Candlestick Patterns Reveal Trend Changes

- Measuring the Strength of Trends with Trendlines

- Chapter 5: Asking Technical Indicators for Directions

- All You Need to Know about Analyzing Indicators

- Determining Whether a Security Is Trending

- Recognizing Major Trending Indicators

- Spotting Major Non-Trending Indicators

- Combining Technical Indicators with Chart Patterns

- Using Technical Indicators to Determine Whether to Be In or Out of the Market

- Chapter 6: Trend Following or Trading Ranges

- Trading Trends versus Trading Ranges: A Quick Rundown

- Trend Trading

- Trading Ranges: Perhaps Stasis Is Bliss?

- Comparing Markets to One Another: Intermarket Analysis

- Putting Securities in a Market Head-to-Head: Relative Strength Analysis

- Part 3: Running the Numbers: Fundamental Analysis

- Chapter 7: Understanding a Company, Inside and Out

- Getting Your Hands on a Company’s Financial Statements

- Assessing a Company’s Financial Statements

- Analyzing More Than Just Numbers: Qualitative Data

- Valuing a Company Based on Data You’ve Gathered

- Chapter 8: Finding Companies Based on Their Fundamentals

- Seeing the Forest for the Trees: The Top-Down Approach

- Starting from the Grassroots Level: The Bottom-Up Approach

- Deciding Which Approach to Use

- Chapter 9: Assessing a Company’s Stock: Six Tried-and-True Steps

- The Six Step Dance: Analyzing a Company

- Step 1: Taking a Company’s Industry into Account

- Step 2: Determining a Company’s Financial Stability

- Step 3: Looking Back at Historical Earnings and Sales Growth

- Step 4: Understanding Earnings and Sales Expectations

- Step 5: Checking Out the Competition

- Step 6: Estimating a Company’s Value

- Part 4: Planning the Trade and Trading the Plan

- Chapter 10: Fail Fast: Managing Risk

- Risk Measurement and Management in a Nutshell

- First Things First: Measuring the Riskiness of Stocks before You Buy

- Limiting Losses at the Individual Stock Level

- Building a Portfolio with Minimal Risk

- Planning Your Exit Strategies

- Chapter 11: Knowing Your Entry and Exit Strategies

- Understanding Market Mechanics

- Surveying the Major Order Types

- Placing Orders as a Part-Time Swing Trader

- Placing Orders if Swing Trading’s Your Full-Time Gig

- Chapter 12: Walking through a Trade, Swing-Style

- Step 1: Sizing Up the Market

- Step 2: Identifying the Top Industry Groups

- Step 3: Selecting Promising Candidates

- Step 4: Determining Position Size

- Step 5: Executing Your Order

- Step 6: Recording Your Trade

- Step 7: Monitoring Your Shares’ Motion and Exiting When the Time is Right

- Step 8: Improving Your Swing Trading Skills

- Chapter 13: Looking at the Scoreboard to Evaluate Your Performance

- No Additions, No Withdrawals? No Problem!

- Comparing Returns over Different Time Periods: Annualizing Returns

- Accounting for Deposits and Withdrawals: The Time-Weighted Return Method

- Comparing Your Returns to an Appropriate Benchmark

- Evaluating Your Trading Plan

- Part 5: The Part of Tens

- Chapter 14: Ten Simple Rules for Swing Trading

- Trade Your Plan

- Follow the Lead of the Overall Market and Industry Groups

- Don’t Let Emotions Control Your Trading

- Diversify, but Not Too Much

- Set Your Risk Level

- Set a Profit Target or Technical Exit

- Use Limit Orders

- Use Stop-Loss Orders

- Keep a Trading Journal

- Have Fun

- Chapter 15: Ten (Plus One) Deadly Mistakes of Swing Trading

- Violating Your Trading Plan

- Starting with Too Little Capital

- Gambling on Earnings Dates

- Speculating on Penny Stocks

- Changing Your Trading Destination Midflight

- Doubling Down

- Keeping Open Positions While You Travel

- Thinking You’re Hot Stuff

- Concentrating on a Single Sector

- Trading Illiquid Securities

- Overtrading Stocks

- Appendix: Helpful Resources for Today’s Swing Trader

- Sourcing and Charting Your Trading Ideas

- Doing Your Market Research

- Keeping Tabs on Your Portfolio and the Latest Market News

- Fine-Tuning Your Trading Techniques

- Index

- About the Author

- Advertisement Page

- Connect with Dummies

- End User License Agreement

Reviews

There are no reviews yet.